Forest Glen

Neighborhood Information goes here.

Neighborhood Information goes here.

Neighborhood Information goes here.

Neighborhood Information goes here.

Neighborhood Information goes here.

If you’re an American citizen, you have the right to vote. Voting allows you to sound off on issues of importance to you and your community by advancing public policies and candidates that build strong communities, protect property interests and promote a vibrant business environment. Register to vote in Chicago – click here or fill out the form below to check your voter registration status.

“The right to vote is the crown jewel of American liberties.” – Ronald Reagan, 40th President of the United States

Learn the issues. Read up on political stances (both local and national) and figure out where you stand.

Use your platforms. Voice your opinions through avenues like social media or op-eds in your local newsletter.

Volunteer. Participate in phone banks, conduct door-to-door canvassing, write postcards or volunteer at campaign headquarters. Your work can help get candidates you believe in elected.

No matter your political party or beliefs, it’s important to exercise your right to vote – and that starts at the polls. Check your voter registration status today & register to vote in Chicago!

If you’re buying a condo or townhouse with commonly shared areas or amenities, the property is likely run by a homeowner’s association (HOA). The fees you pay to the association, otherwise known as HOA fees, go towards the ongoing and future maintenance of these amenities and spaces.

The fees can be collected monthly or yearly, and the amount is influenced by a number of factors:

Unlike co-ops or townhomes, everyone who owns a unit in the condo building chips in money to take care of the communal spaces. In Chicago, historical buildings and buildings with high-cost features like elevators and pools are more likely to have higher fees.

Unlike a condo, you aren’t buying an individual unit. Instead, you buy shares in a corporation that owns the entire building and get a stake-hold to a specific unit. Services will still be bundled into singular community payments like HOA fees. LEARN MORE

Ask your REALTOR®! They can provide the full list of included services from the listing.

An HOA payment is divided into two major areas: routine maintenance costs and savings for the association’s reserves. These reserves are applied towards “capital expenses” which are typically large-scale or emergency in nature. For example, repairing or replacing the roof is a common reason to dip into reserves.

The reserves are intended to help cover the remaining costs the building insurance doesn’t cover. If the reserves aren’t enough, then a special assessment may be implemented. Even though your HOA fees will include building insurance, it’s highly recommended, and often required, that you get homeowners insurance for your individual unit and personal property.

Luckily, large expenditures like replacing the furnace or the roof are spaced out over many years. When it’s time to use the reserves or mandate a special monetary assessment, the homeowners association will vote on what to do.

The homeowners! Typically, the association board members are elected from within the residents by all the residents in the building. During the regular HOA meetings, homeowners can discuss big projects or issues. When major decisions need to be made — like dipping into the reserves — all homeowners vote on it.

The board follows and implements official rules, bylaws and processes. These are sometimes called covenants or CC&Rs (Covenants, Conditions & Restrictions). CC&Rs determine what kinds of changes can be made to the exterior of your home, determine if you can own pets (and, if so, what kind), state what qualifies as a quorum on major projects in need of a vote and so on.

Chapter 13-72 of the Municipal Code of Chicago is the City of Chicago’s Condominium Ordinance. This is an official government document that protects the rights of the tenants in condo buildings. You should get a copy from your REALTOR®.

The condo association’s documents will be shared with you when you enter the attorney review period. Ask your REALTOR® to provide a complete journey of the transaction!

In Chicago, HOAs are a common entity. Explore different neighborhoods and building types if you’re interested in a condo but would like to target a specific price point in monthly HOA fees.

Here are some helpful considerations you should make as a prospective buyer so you can evaluate if a building with an HOA is the right fit for your living style:

When in doubt, ask your REALTOR® about HOA fees during the homebuying process.

Congratulations! You’ve bought a new home. Move in, get comfortable and check off the items on this list for your personal security and preparedness.

Then, get comfortable, set up your new space and have piece of mind knowing your new space is ready for you!

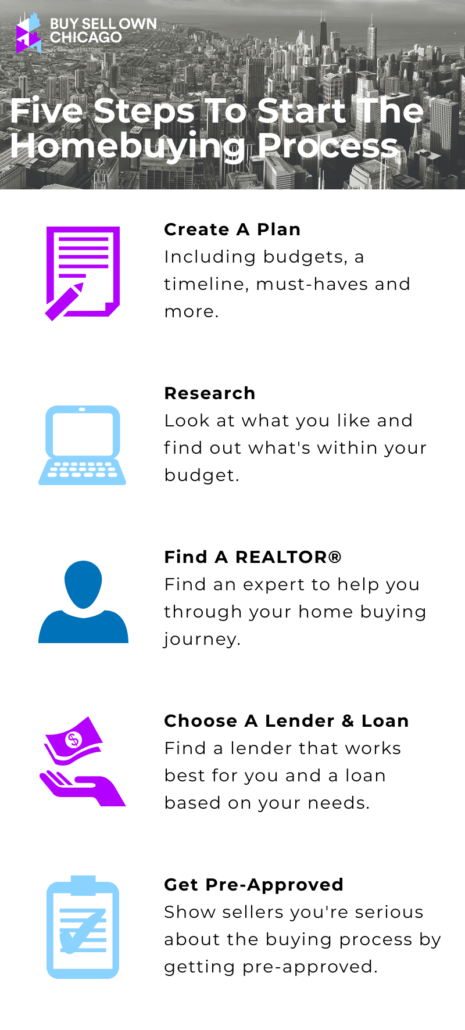

The long and winding road to home buying can be confusing and scary, but it doesn’t have to be! Here are five easy steps to follow in the beginning stages of the home buying process, because knowing the route will help make the ride to your new home smoother and less stressful.

Of course, you want to look at houses. But first thing’s first, do your research and make a plan. Get an idea of your budgets so you know what you can afford. Create a timeline of when you would like to purchase a home and move. Make a list of must-haves, as well as things that would be nice to have but aren’t necessities. Having a plan in mind will help you navigate further down the road.

Don’t worry, this research is the fun kind! Take a look at listings online to get a feel for what you like, as well as what will and won’t fit into your budget.

Your REALTOR® will be your guide during this time. Make sure you find the right one for you. They will be your expert and go to on this journey, so don’t be afraid to interview multiple REALTORS® find the one that fits your needs. Use our REALTOR® search to find a Chicago REALTOR® who fits with you!

Your REALTOR® can recommend trusted lenders to begin the loan process. Each mortgage lender, depending on the company they work for, will be able to provide different fees, rates and requirements, so make sure to find the one that works best for you.

Then, you will work with your lender to decide which mortgage type is right for you. Options include fixed-rate, adjustable, conventional or government loans, to name just a few.

The last step before you start looking for your forever home is to get pre-approved. Your lender will ask for a variety of documents, from proof of income to bank statements and more, which will all determine what amount you will be able to spend on a home. But remember, a pre-approval does not mean you are guaranteed a loan. Think of it as a way to show buyers that you’re serious about buying a home and making an offer.

From here, it will be time to looking at places and get that much closer to making your homeownership dreams come true!

Download our infographic for referrence and to share with your peers!

Credit scores are a vital part of getting approved for a loan to buy a home. Although you can get a mortgage with a lower credit score, the better your credit score, the better your loan terms will be. If you’re looking for ways to improve your credit score, look no further. Here are our top tips to improving your score for a better mortgage.

Your payment history is one of the biggest impacts on your credit score. The more frequently you pay your bills by the payment deadline, the better your score will be. If you’re behind on your payments, the first step is to get up to date on them.

Then, make sure to continue paying your bills on time and in full, if you can. Either get notifications for when your bills are due or set up automatic payments, so you don’t miss a due date.

Another large determining factor of your credit score is credit utilization, or how much you owe on a credit card compared to your credit limit. Lenders typically look for a ratio of 30% or less. You can positively impact your credit utilization by keeping your credit card balances down or paying off any debt you have on your cards. Calculate your credit utilization here.

Having a mixture of credit doesn’t necessarily lead to a better credit score. Unnecessary credit can even harm your score by creating inquiries on your account and possibly leading to overspending.

However, if you have an unused account, don’t close it! If the account doesn’t charge you annual fees, closing it could lead to a higher credit utilization ratio.

Make sure to check on your credit reports every so often. If you notice inaccuracies, such as late payments or incorrect amounts owed, these are all factors that can drag down your score. If you notice an inaccuracy, make sure to dispute it right away! Click here for more information on receiving a free credit report.

Whether you just bought a home and are looking to update the space to fit your needs, or you’ve lived in your home for years and notice wear and tear or your preferences have changed, you might be ready to change things up. Do you know where to start? Here are the steps to follow to begin the renovation process:

During your project, you may not be able to have everything done you want. Does the space need a full renovation, or can you just update parts of your home? Deciding the extent of the project and what needs to get done versus what you would like to have done is great to determine a budget and cost later in the process.

Envision what you want your new space to look like, and do research to get ideas of how to get there. Look into designs and make a list of what you’ll need to purchase to get the job done. This will also help you begin to get an idea of a budget, as you determine the cost of the materials you’ll need. Check out Pinterest or Houzz to get inspired.

Next, do your research on budgets to get an idea of the extent of your project. Is a full renovation possible, or would a partial project be more ideal? Having a general idea of what materials and furnishings will cost will also help you figure out how much you can spend when hiring someone for the job.

Is this a smaller project, like painting or refinishing something, that you think you can do on your own? Or will a professional need to be hired? Determine which direction you want to go.

Hiring a professional will determine if the jobs gets done correctly and up to your standards. Start getting quotes from professionals. It’s best to get more than one, to determine the best person for the job at the right price.